Harness cutting-edge algorithms with Zephyrus Force, a game-changing trading system designed to elevate your strategy.Featuring 2 parallel cloud bands, this system adapts dynamically to price movements, delivering unparalleled accuracy in trend analysis across all market conditions and timeframes.

Watch Zephyrus Force dominate the REAL-TIME market, 16 wins in 17 mins!

9 reasons why Zephyrus Force is among our ultimate innovation

Built-In Support/Resistance Levels

With real-time Support and Resistance levels, you can:✔ Identify key levels instantly – Support/resistance is marked when cloud bands flatten and disappears once price breaks through.✔ Adjust their duration – Tailor support/resistance levels to match your preferred trading style.✔ Utilize cloud bands as dynamic barriers – Price rarely moves beyond these bands, offering high-probability trade setups.

2 Advanced Trading Zone

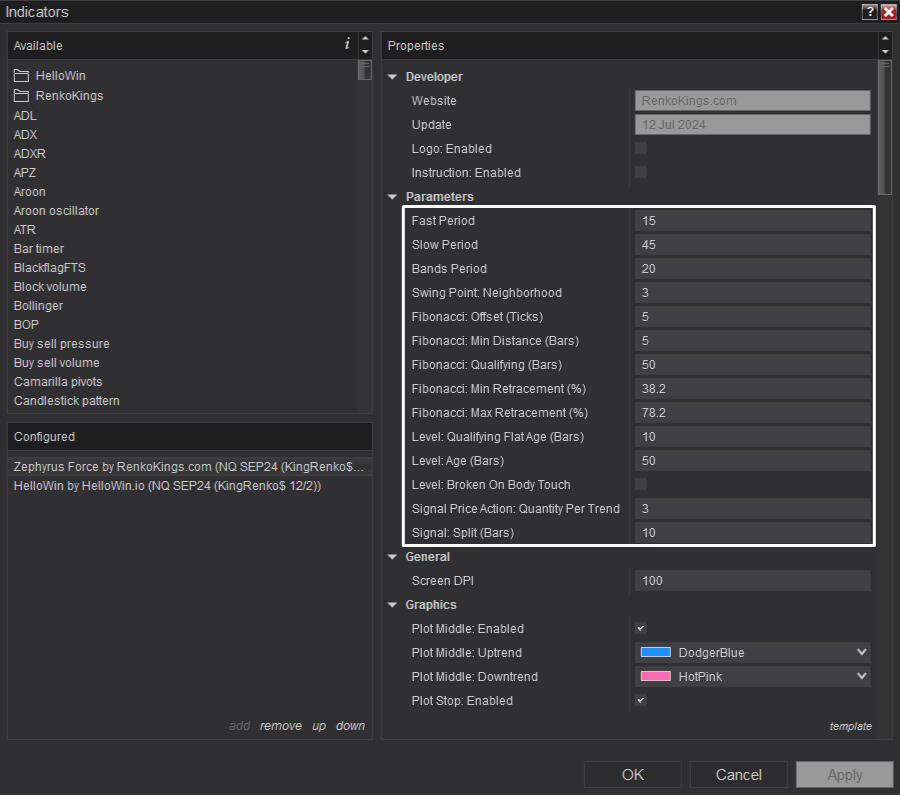

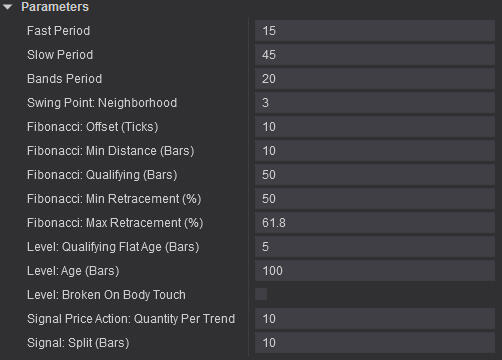

Take advantage of two specialized trading zones designed for pinpoint pullback opportunities:✔ Fibonacci Trading Zone – Generates Fib signals when price hits key Fibonacci retracement levels you set.✔ Cloud-Based Trading Zone – Uses two cloud bands to detect Price Action signals, helping you spot high-probability setups with greater confidence.Customize these zones to align with your unique trading strategy and risk tolerance.

Double Signals - Double Rewards

Zephyrus Force offers 2 robust pullback signals, allowing you to capitalize on market retracements:✔ Fib Signal – A buy/sell signal is triggered when the price reaches your specified Fibonacci levels.✔ Price Action Signal – In an uptrend, when the price retraces into the lower cloud band (support), the system waits for a green candle inside the cloud to generate a signal. The opposite applies in a downtrend.

Unique Trailing Stop for Peak Performance

Enhance your risk management with a refined, price action-driven Trailing Stop.When price breaks out of flat cloud phases or key support/resistance levels, the system suggests a Trailing Stop along the cloud to secure profits while avoiding premature exits.

Compatibility with All Bar Types

Whether you trade Renko bars or minute charts, Zephyrus Force adapts seamlessly.We designed this system for universal compatibility across all bar types.

A Complete Trend-Following System

The proprietary algorithm of Zephyrus Force delivers a reliable trend analysis you can trust.This system also differentiates the various phases of a trend: start, strong/weak uptrend, strong/weak downtrend, or sideways movement.

Versatility Across Trading Methods

Zephyrus Force is tailored to support various trading styles.Whether you’re a scalper, day trader, or swing trader, this system has you covered.

Intuitive and Aesthetic Interface

Zephyrus Force features a vibrant, color-coded interface that makes spotting trends and signals straightforward and intuitive.The aesthetic design enhances usability, making it accessible for traders of all levels.

Ultimate Flexibility for Customization

You can adjust the retracement ratio and the length of support/resistance levels to align with your unique trading approach.

Want to see more? Watch Zephyrus Force's robust power on NQ…

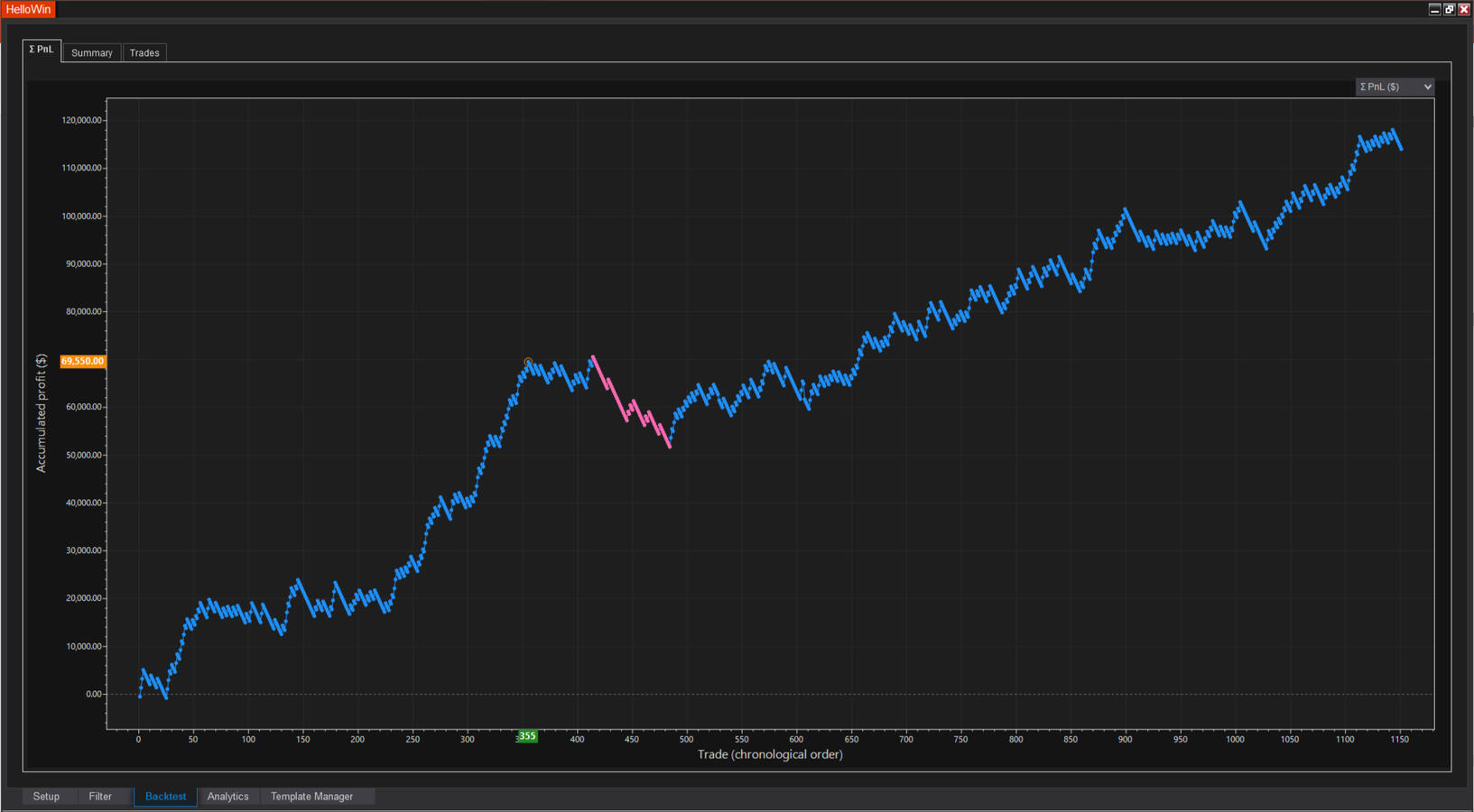

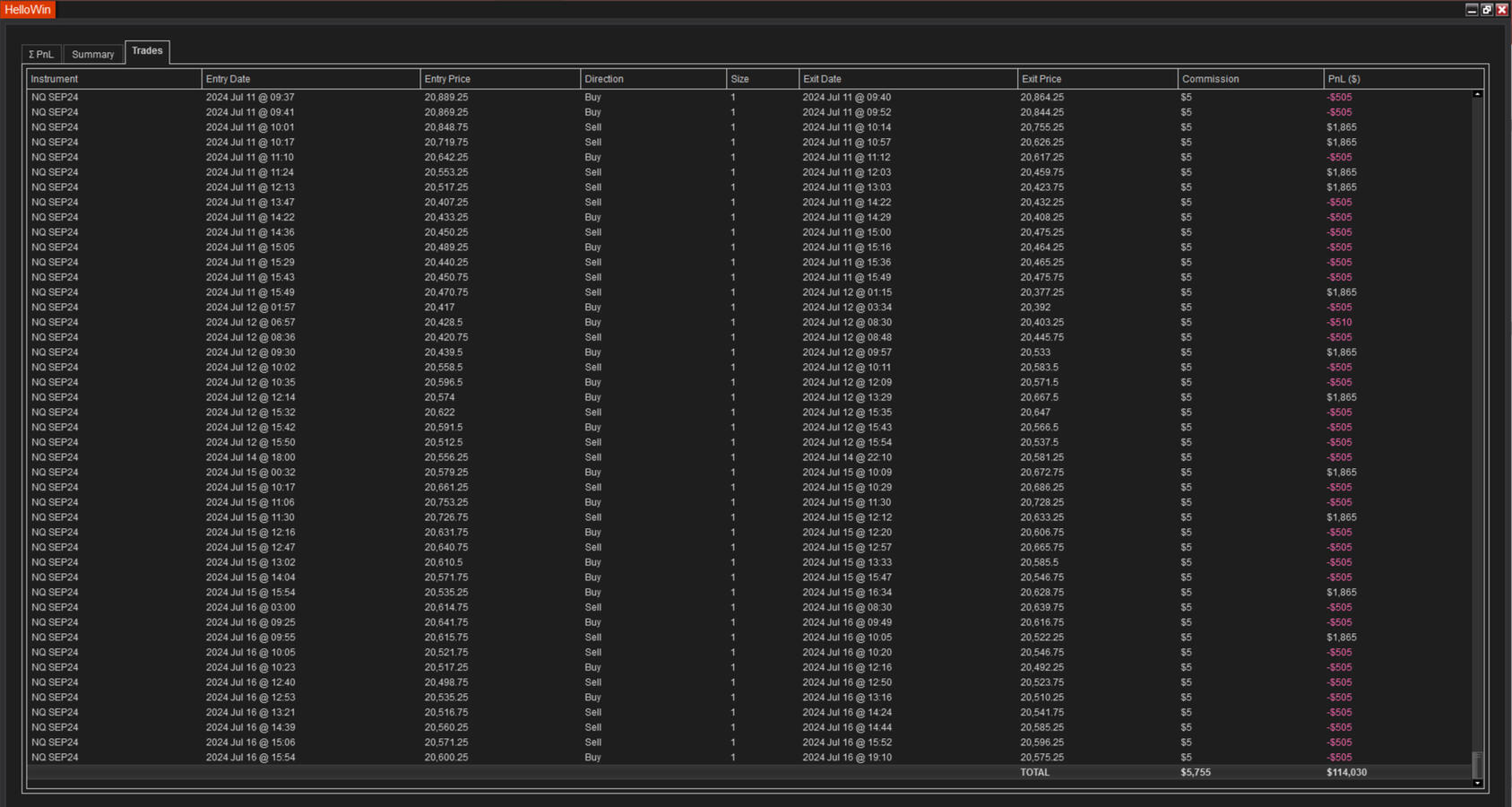

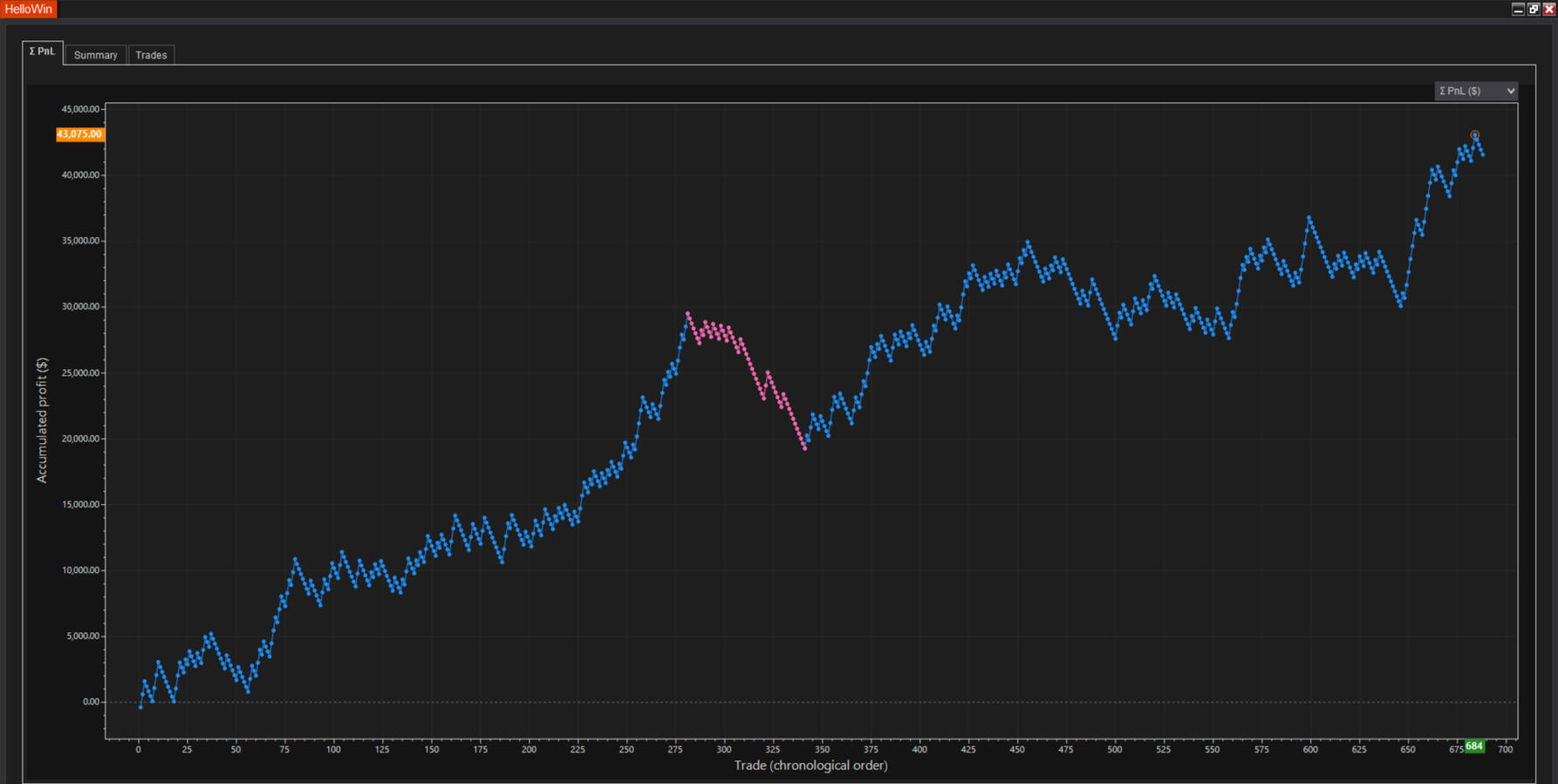

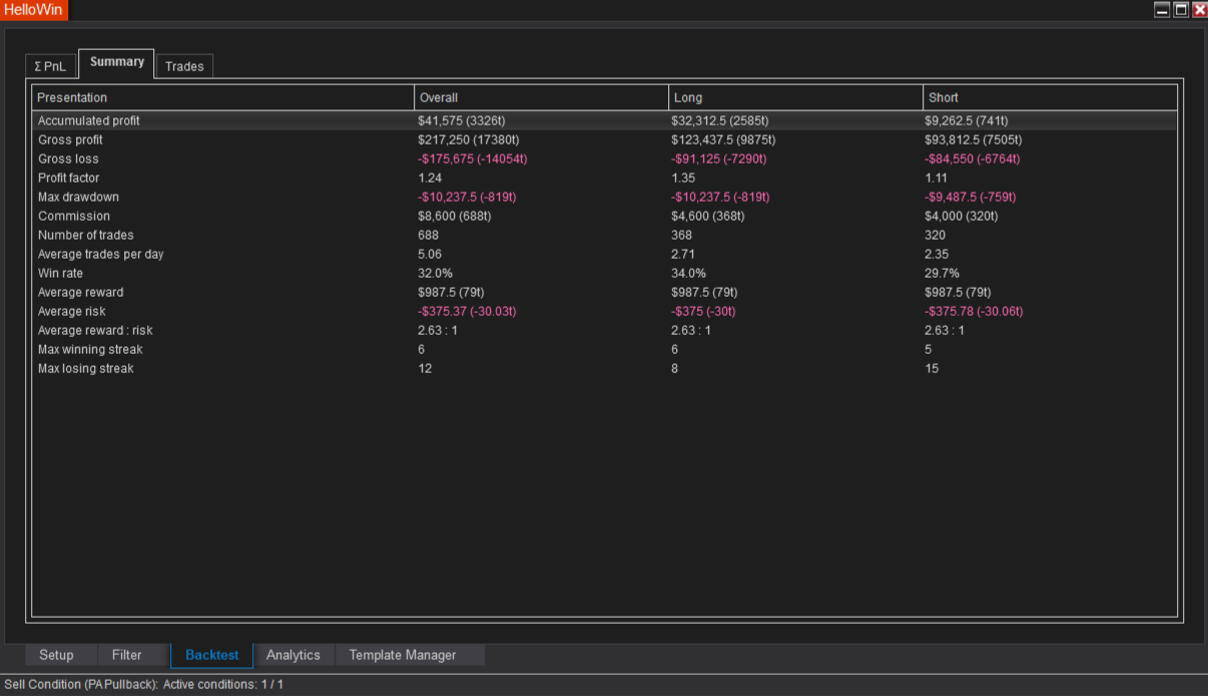

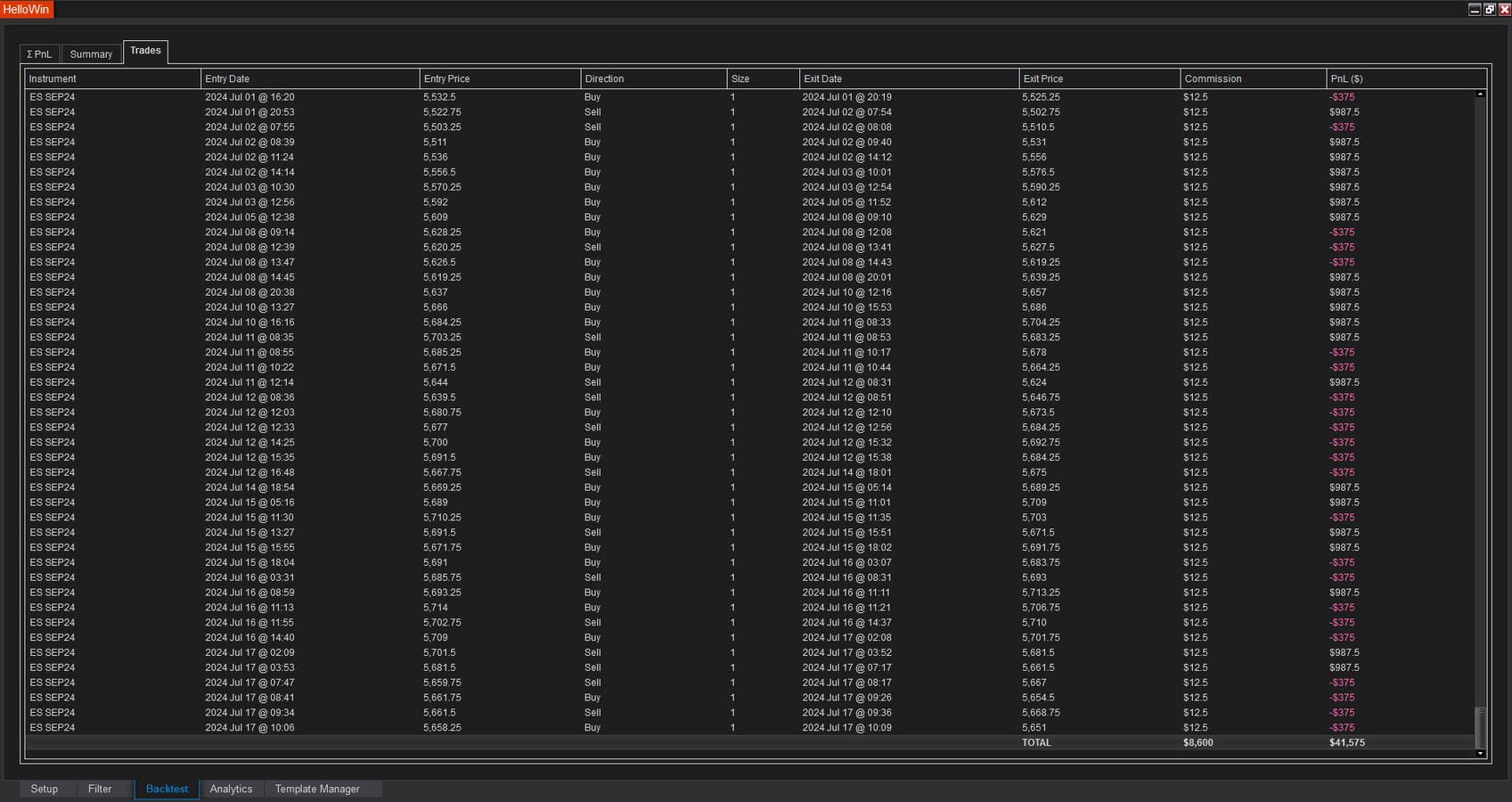

Zephyrus Force showcases impressive backtested results across major futures indices. NQ, YM, and ES demonstrate high average reward, providing robust confirmation of the system's potential.

… impressive performance on ES for 200 days…

… and amazing results on YM.

The public price of this COMPLETE trading system is $2196.

But today is your lucky day...

Snag this unique chance to acquire Zephyrus Force at $796 & enjoy FREE EOB Ordering + KingRenko$ (value $1,100)!

This offer will only last for a few days, and you wouldn't want to miss it.

For real...

Who are we?

We are ninZa.co, a leading provider in the NinjaTrader ecosystem with over 10 years of development experience. As one of the largest vendors in the NinjaTrader Ecosystem, we have established ourselves as a trusted provider in the NinjaTrader community.

At ninZa.co, we serve as a one-stop shop for over 200 professional NinjaTrader indicators of various types. Our products have gained recognition and support from over 50,000 NinjaTrader users across all continents.Join our friendly and constructive trading community at HelloWin forum. Come and say "HelloWin" and you will receive a $300 voucher ^^

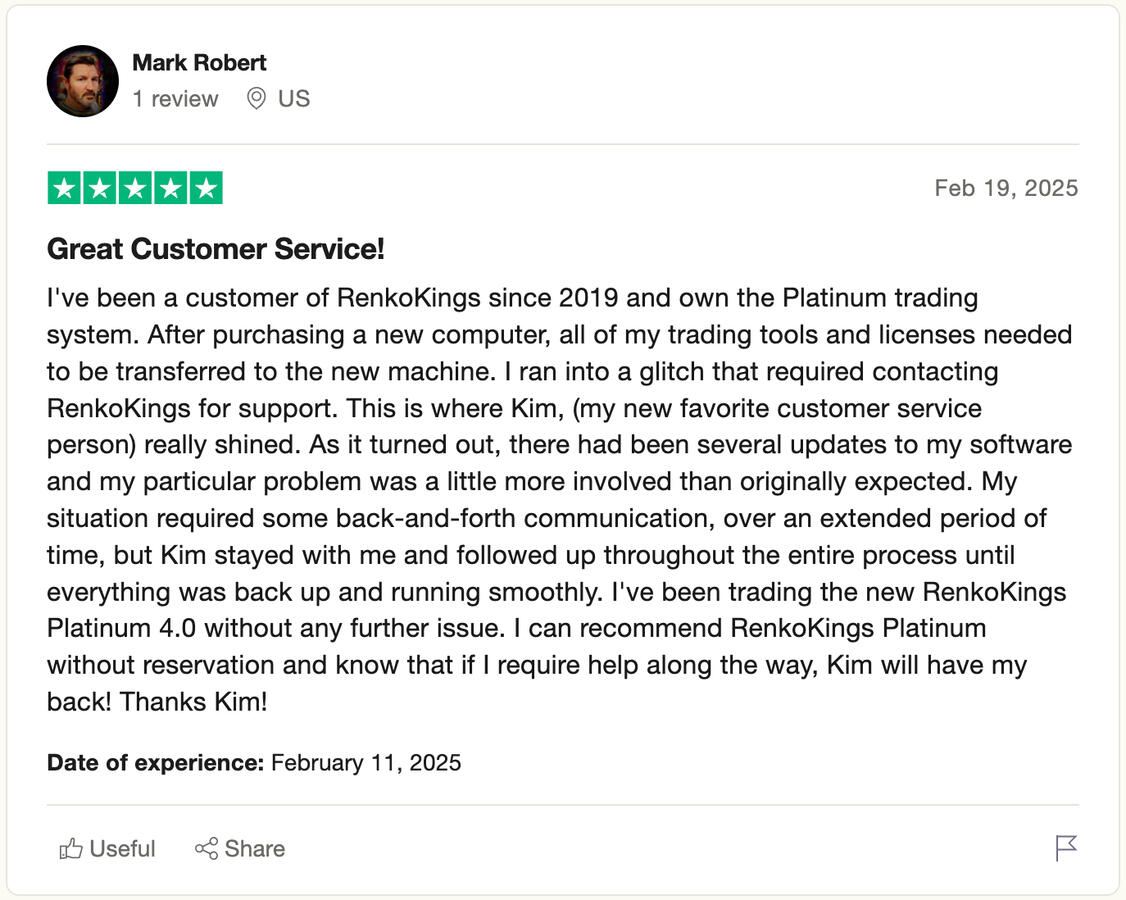

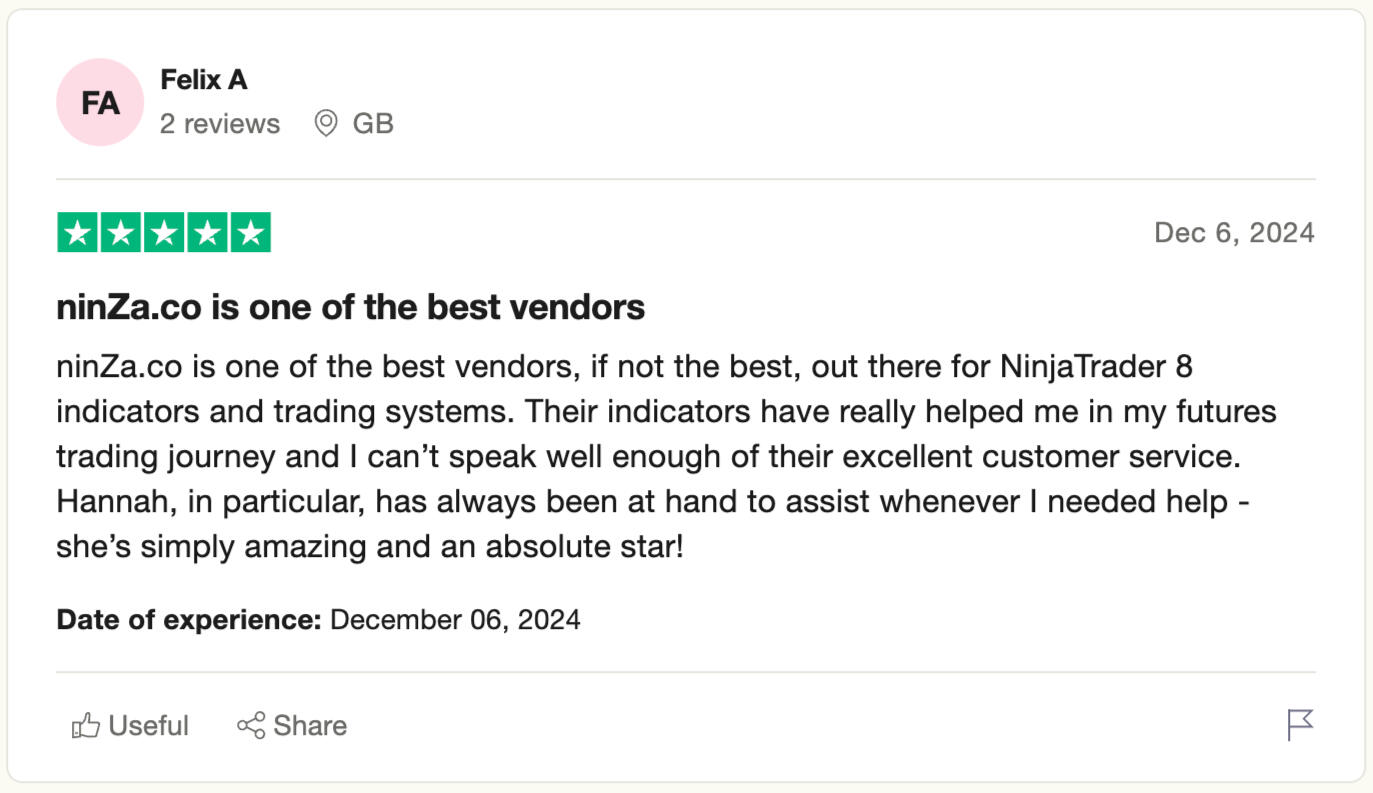

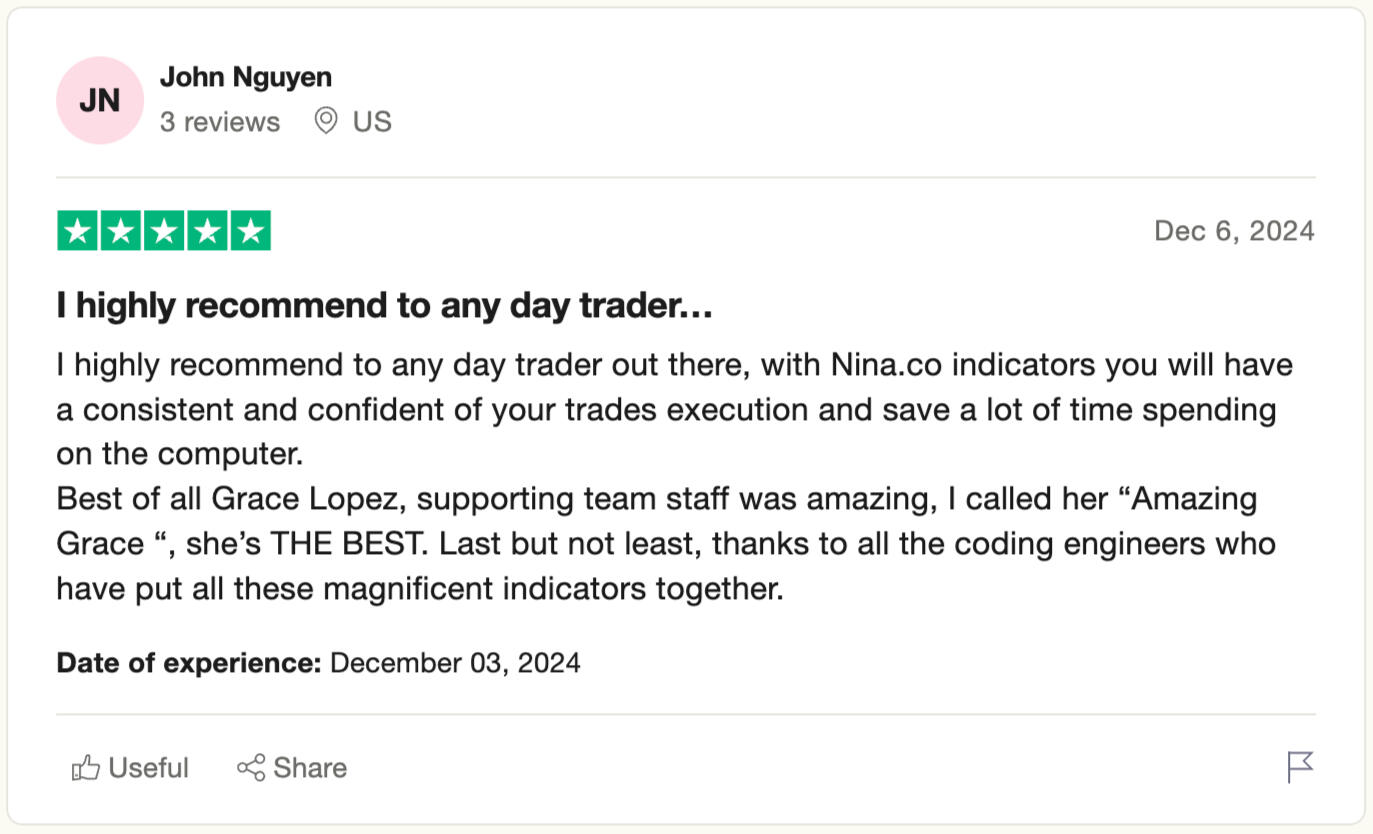

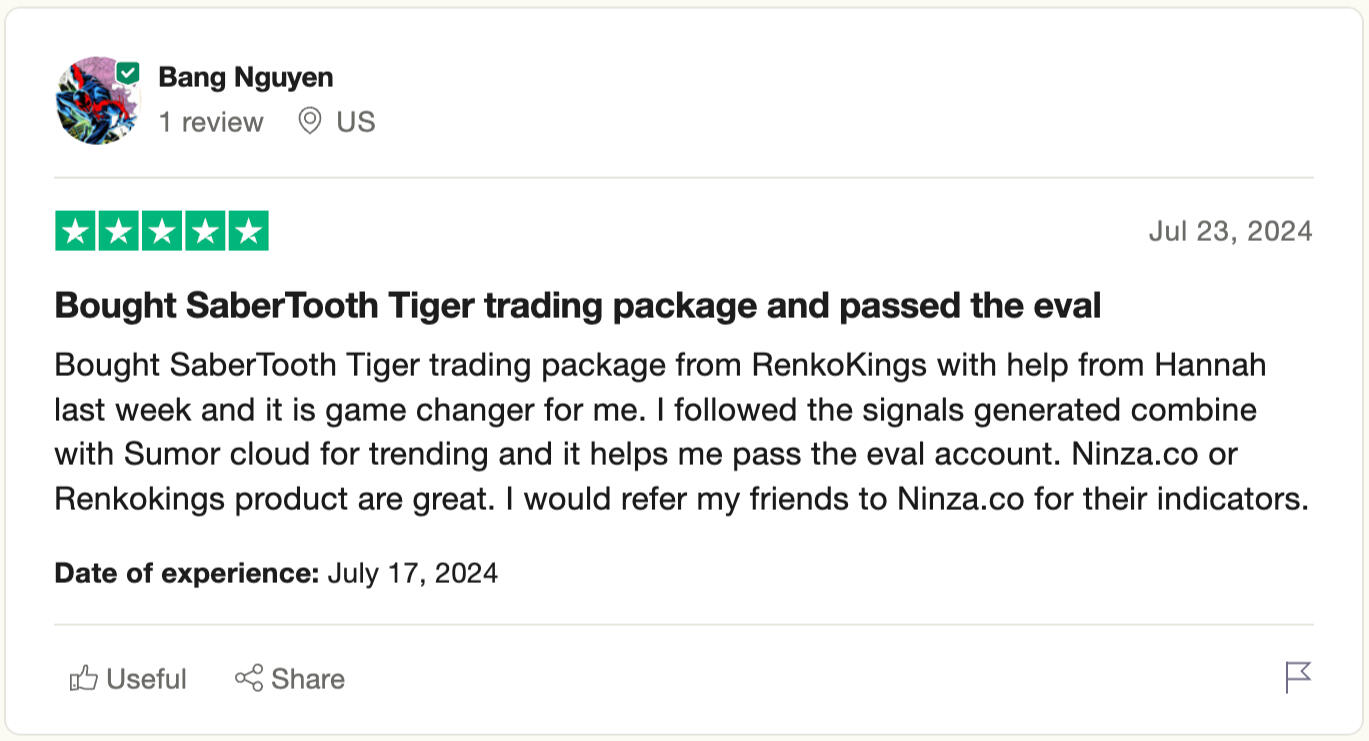

We are proud of our 5-star Customer Support service

* These testimonials may not be representative of the experience of other users or customers, and do not guarantee future performance or success.

Futures, foreign currency, and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.